Fairway Nurse Financing System

Additionally need certainly to see standard debtor standards toward House Possible and you can HomeOne choices including that have a credit history from no less than 620, an obligations-to-earnings proportion (DTI) out-of forty-five% otherwise smaller, and you may a strong credit rating.

In which Fairway comes in

BorrowSmart contains the down-payment guidance. But Fairway also provides a lot more offers as high as $599 using a couple Fairway-exclusive advantages. Fairway will offer licensed individuals good $five hundred borrowing from the bank into the their home appraisal, or we shall afford the appraisal payment (whatever was quicker).

We will including shelter the $99 fee to the borrowing guidance course all the BorrowSmart homeowners need to over in advance of the financing is also personal.

Bonus: If you don’t be eligible for this new BorrowS nevertheless move ahead that have a separate loan system having Fairway, you can easily nonetheless rating an assessment borrowing from the bank to $500.

HomeOne compared to House You can

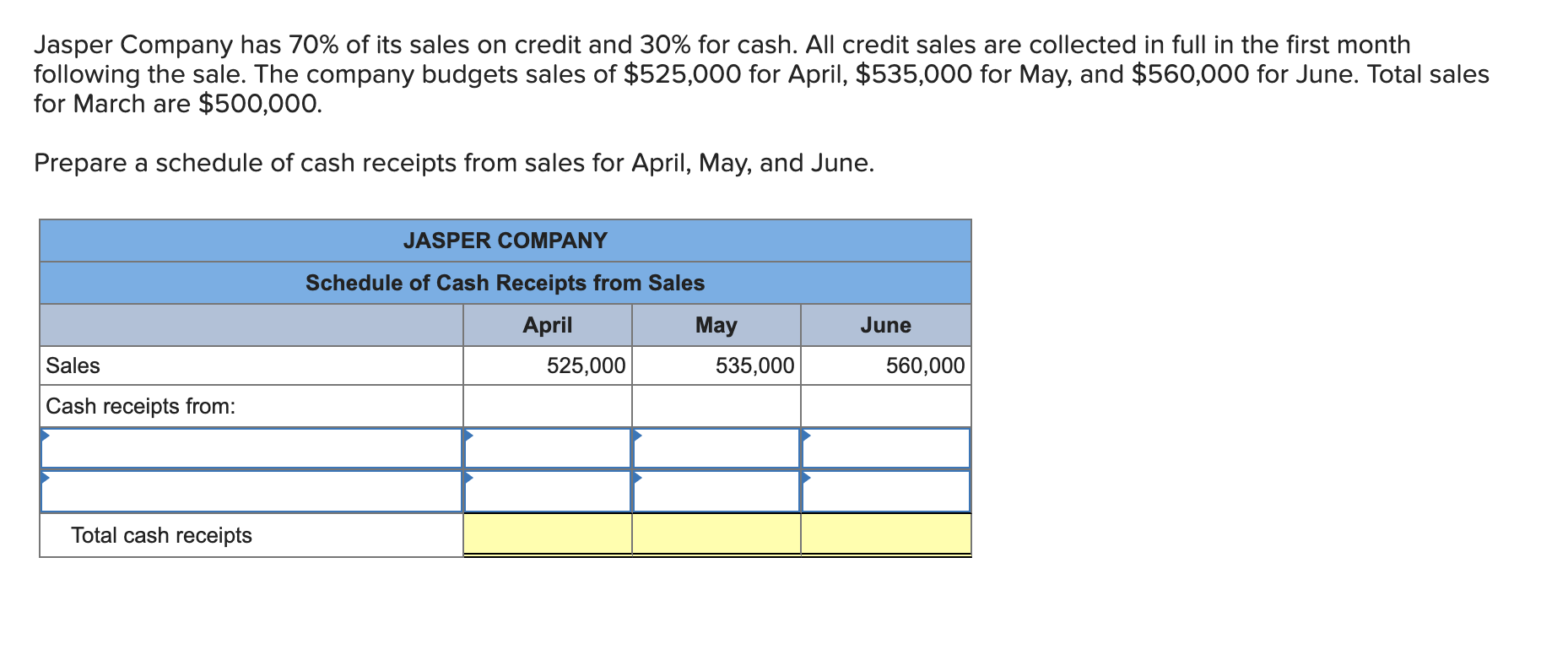

The new HomeOne and you may Domestic You’ll loan products try equivalent for the reason that they have been each other 3% deposit antique finance provided by Freddie Mac computer. But there are numerous differences.

The biggest difference in those two mortgage offerings ‘s the earnings needs. Otherwise know that you qualify for, to not ever care and attention. A Fairway loan officer is also pick it up to you personally whenever you have made preapproved.

*Personal mortgage insurance rates (PMI) applies to antique finance when the borrower’s downpayment are less than 20%. When you reach 20% equity yourself, you could potentially demand that your bank take away the PMI requirements. PMI ends immediately within 22% family equity.

Nurses anyway levels of brand new community can put on with the system, even current medical college students and the ones nonetheless in the medical college or university. That will offer a life threatening improve on the homeownership when you’re this new for the career and so are maybe not a top-earner.

Earnings criteria

A button feature of one’s BorrowS is the advance payment recommendations solution, and how much your be eligible for utilizes your income.

- Over 80% AMI at otherwise less than 100% AMI

- Buy property must be inside the large needs tract

- HomeOne program only

- Deposit guidance: $step one,000

- Over fifty% AMI and at or less than 80% AMI

- Household It is possible to system just

- Advance payment advice: $1,000

- During the otherwise below fifty% AMI

- House You can system simply

Do not know your regional AMI? Which is Ok — most people try not to. Searching it for the Freddie Mac’s Income and you may Property Qualifications Unit.

So if you’re undecided if you be considered, apply in any event. A Fairway mortgage manager allows you to through the processes and inform you your qualifications.

In the event it looks like your earnings is simply too large to your BorrowSs are a selection for your — and you will nonetheless get the $five hundred appraisal borrowing so you’re able to save well on your closure can cost you.

Assets criteria

This is actually the cool thing about multifamily property: you can use them in order to jumpstart forget the profile. One of several devices need to be the majority of your household, but you can book others out and make use of the fresh new rental earnings to offset your own mortgage repayments otherwise build-up their financial investments and you will savings.

If you reside in a condition in which BorrowSmart is not offered, you might still qualify for a good HomeOne otherwise Home Possible mortgage, or some other sorts of home loan.

Low down percentage conventional, Virtual assistant, and you may FHA financing can also be found all over the country. Zero off USDA funds appear around the world as well, though just being qualified rural and you will residential district areas are eligible.

Documenting your earnings for a nurse financial

The loan manager and you may financing processor will say to you just what they must upload your application in order to Underwriting getting acceptance. Nevertheless really helps to get arranged before you apply. Quicker you can fill out your documents, the earlier you’re going to get an answer.

Leave a Reply