Brand new Agency away from Experts Items doesn’t need Va borrowers so you can enjoys an escrow take into account their property fees and you can insurance fees.

However, really loan providers create require it just like the a condition of one’s loan. The reason being it provides a supplementary level regarding safety getting the lending company. By the ensuring that property taxes and you will insurance costs are reduced for the time, the lending company is confident that the house doesn’t slip toward disrepair or deal with courtroom conditions that you are going to affect the loan’s well worth.

Who do I Shell out Escrow to help you?

Va individuals spend the 3rd-cluster Va bank, a lender which is approved by the Va so you can originate and you may create Virtual assistant loans. These types of third-class loan providers offer Va funds in order to qualified experts, active-obligations military members, and their family. These firms are not connected to the fresh Service of Pros Points however they are approved by them to give Va finance. He’s usually private loan providers eg banking companies, borrowing unions, and you can home loan organizations.

When consumers discover a Virtual assistant financing from a 3rd-people bank, he is accountable for and come up with its home loan repayments straight to the lender. The financial institution uses the brand new repayments to purchase dominating, attention, taxes, and insurance towards the property.

If a lender accidently takes more income on borrower than just they are obligated to pay, the debtor is always to get in touch with the financial institution immediately to help you fix the issue. The lending company must reimburse one overpayments on borrower. Yet not, in the event the debtor owes more income than just it repaid, they shall be accountable for paying the remaining equilibrium.

Perform Va individuals get that cash return at the conclusion of the year?

At the conclusion of the entire year, lenders could possibly get question a reimbursement if for example the debtor overpaid the escrow membership, which is used to spend assets fees and you can insurance fees. The new refund is typically approved inside thirty day period of avoid of the year.

Is Escrow be Waived for the a beneficial Virtual assistant Loan?

In some cases, Va lenders may succeed borrowers to waive an enthusiastic escrow membership. Although not, this isn’t a familiar behavior, and you can Virtual assistant mortgage individuals have to generally see certain standards so you’re able to meet the requirements. For example, consumers might require a high credit history, a decreased financing-to-worthy of ratio, and you can a substantial down payment.

You will need to remember that waiving an enthusiastic escrow account appear having particular risks. When the https://clickcashadvance.com/personal-loans-az/ borrowers don’t spend their property taxation or insurance fees timely, they may face late fees, punishment, and also foreclosure. In place of an escrow membership, this new debtor can make such payments right to the proper parties.

The conclusion into Escrow to own Virtual assistant Loans

A keen escrow membership is not required to take out a beneficial Virtual assistant mortgage, however, lenders recommend doing so so as that your property fees and you can insurance fees is repaid on time.

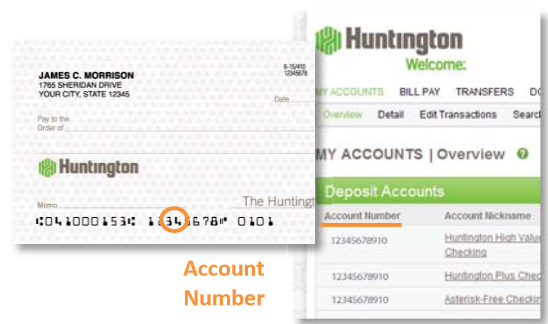

Once the a note: an escrow account is actually another membership stored by a 3rd party, for example a lender, you to definitely gathers and you will will pay particular expenses with respect to the fresh new borrower. This can include assets taxation, insurance premiums, or other expenses pertaining to the property.

While a beneficial Virtual assistant mortgage borrower and also have questions about escrow accounts otherwise should it be very important to the loan, you must confer with your bank. They are able to bring much more information concerning the specific requirements for your mortgage which help you understand the huge benefits and you can risks of playing with a keen escrow membership.

In the course of time, whether or not to fool around with a keen escrow membership was your own decision that needs to be made according to your private means and financial predicament.

Va Loan Restrictions for 2024

Virtual assistant financing arrive to $766,550 in most section but could surpass $1,000,000 to possess single-loved ones belongings in highest-cost counties. Calculate the Va financing maximum to see their custom mortgage limitation. Financing restrictions try not to apply at all the individuals.

Leave a Reply