- As to the reasons utilize your own house’s equity: House collateral are used for requires such expenses, renovations and you will expenses.

- What you should thought: You’ll find 3 ways in order to make use of their house’s security: domestic guarantee loan, HELOC and a cash-aside re-finance. For each solution also provides novel gurus and situations.

- Opt for the best selection: Choose the alternative aligned along with your monetary goalspare will set you back, words and you will advantageous assets to create an informed choices.

If you are looking having ways to get bucks to own expenses, home renovations or any other costs, your residence security you may give an answer. You will find several way to tap into your own security, regardless if. good HELOC versus. refinancing with cash-out.

Home values when you look at the Washington have raised in the past long-time, ultimately causing of several property owners to adopt borrowing against its house’s collateral. What exactly is collateral? The difference between the value of your residence and matter you will still are obligated to pay on the mortgage.

Such, if for example the residence is currently valued in the $450,000 considering property assessment and you’ve got a great $175,000 balance remaining on your home loan, you might have up to $185,000 inside guarantee. You might be in a position to borrow on the security if you you desire funds to have solutions, restorations, debts and other costs. If you find yourself lenders won’t generally speaking loan the full value of one’s residence’s security, they may mortgage around 80% of it typically.

- With a house security mortgage

- Which have an effective HELOC (House Guarantee Credit line)

- From the refinancing the financial with a finances-aside alternative

House guarantee financing: The fresh regular options

A property collateral mortgage spends the new guarantee of your property because the equity. Normally, the lender often arrange for a property appraisal so you can well worth your household. Which have a house guarantee mortgage, you’d acquire an appartment count in the a fixed interest and you may pay it off within the equivalent monthly installments similar to you do having a car loan.

- Your rate of interest does not vary, as a result of the fixed rates

- You realize just how much you are able to spend per month

- An initial fee for your requirements of your own whole amount borrowed

HELOC: Independency & choice

An excellent HELOC, otherwise home security credit line, as well as borrows against the collateral you really have in your home. HELOCs typically have variable rates, which means that your interest often fluctuate up and down which have the market industry.

Example: Let’s say you are approved to have an excellent $thirty-five,000 HELOC. You withdraw $5,000 from your own HELOC to spend some immediate expenses. Four weeks later on, your withdraw $10,000 to fund your bathroom renovate. To date, you’ve got utilized a maximum of $15,000 of one’s HELOC financing, leaving $20,000 however offered.

Your own monthly payment into the a HELOC will be based upon your complete a fantastic balance, if the count used was removed as the a-one lump sum otherwise just like the multiple improvements.

Particular loan providers, like Desert Monetary, promote a hybrid HELOC towards the option of a predetermined price to your particular withdrawals. These types of financing permits you the flexibleness away from a traditional HELOC if you are nevertheless providing the assurance away from a set interest rate.

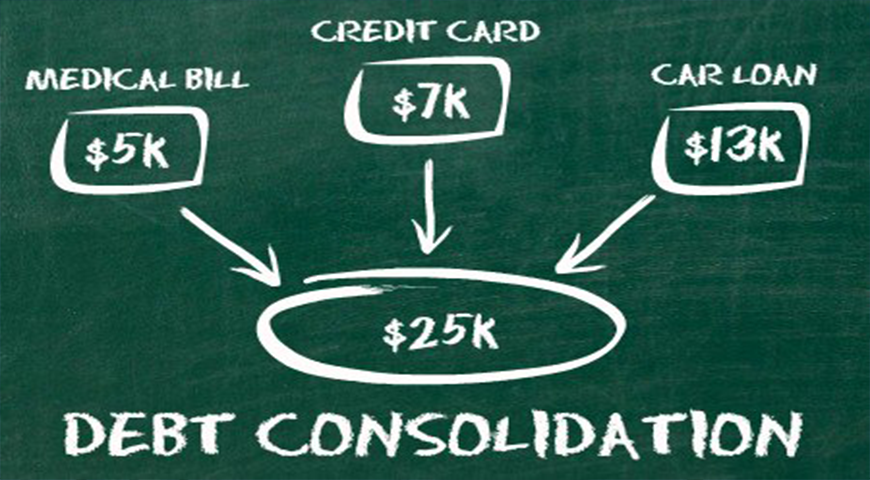

These types of mortgage works well having times when you could need to have the cash in reduced increments over the years – like, if you are intending to complete several restorations tactics in the future age or if you have multiple goals we wish to started to (particularly consolidating large-desire loans money and you may investing in family solutions).

Refinancing: One to financing to possess what you

The next choice for tapping into your house equity was refinancing their mortgage that have a finances-away choice. Within scenario, you are replacement your existing home loan with a new domestic loan to have a larger amount than your currently owe when you look at Holly Pond payday loans no credit check the order to view money from the offered equity.

Why don’t we return to our very own $450,000 domestic worthy of analogy, where your existing financial harmony was $175,000. Your work at your own bank discover $50,000 cash out with a mortgage re-finance. So, your financial number will be $225,000 – your $175,000 harmony as well as the most $50,000 bucks youre credit in the collateral of your home.

Your home loan have a fixed or varying interest rate according to the types of mortgage. New upside out-of a predetermined speed would be the fact your fee amount may be the exact same monthly, making it very easy to arrange for. Although not, if rates decrease, you would not immediately have the lower rate. Which have a changeable rate, possible make the most of reasonable products throughout the market; but not, you might have their rate increase having grows on the markets.

Just how for every single loan rises

Now you see the principles of every loan variety of, let’s check exactly how property security financing, HELOC and money-out refi stack up in terms of will set you back and you can masters. Just remember that , its not all financial offers most of the about three financing systems, and each financial gets more conditions and possibilities to own making use of their home’s guarantee. Consult with your credit connection otherwise mortgage lender for truth with the home security selection.

Providing they house

Sooner or later, regarding accessing the fresh offered collateral of your house discover benefits and drawbacks every single financing solution. A standard repaired-speed domestic security mortgage is perfect for a one-day need if you’re cost try reduced, while you are a funds-aside re-finance is best suited if you would like stay glued to an excellent unmarried mortgage commission. A house security line of credit having a fixed-rates option regarding Wasteland Financial now offers one another independence and you may serenity out of brain, especially if experts such a reduced basic rate in addition to function so you’re able to borrow cash since you need it are important to you personally. Contact me to discuss the options for household collateral and you may refinancing mortgage!

Leave a Reply