This really is a casino game changer: Cornerstone was offering our consumers market-leading home loan repair sense. Towards discharge of our very own the brand new inside the-home maintenance system, members can without difficulty manage the financial account anytime, anywhere. All of our most readily useful-tier technical platform allows people do everything away from examining escrow activity and you may scheduling money so you’re able to strategizing financing payoffs and you can opening associated resources, as well as crisis relief pointers. First of all, readers will still be capable see custom solution and you may service from your caring associates.

HOUSTON, Cornerstone House Lending, among the many country’s premier residential home loan enterprises, introduced its full solution, in-domestic home mortgage servicing process for brand new loan originations, consolidating its 34-12 months heritage of premium support service which have community-top financing servicing innovation.

Cornerstone has made tall assets to construct a top-notch class from servicing professionals contributed of the Toby Wells, Cornerstone’s Handling Manager out-of Loan Maintenance

Bringing an amazing consumer experience stays among Cornerstone’s trick Key Beliefs since the founding 34 years back, and then we was delighted to provide our very own home loan maintenance consumers an identical level of brilliance who has got much time discussed Cornerstone’s loan origination businesses. Our very own compassionate minds, service-inspired culture, business soul, and you visit this link may romantic commitment to brilliance set Foundation aside, with in professionals to optimize client satisfaction. Rewarding the corporate duty to include an amazing buyers expertise in the mortgage upkeep function means Foundation when deciding to take complete control and every single day control over the entire maintenance techniques. Foundation users will remain on advanced care of Foundation party members in loan origination and closing techniques, and from now on through the lifetime of their mortgage, said Adam Laird, President off Cornerstone.

Foundation may also changeover its existing home mortgage upkeep collection in order to the business’s inside-house system from the coming months. Cornerstone’s strong maintenance platform aids and you may streamlines every aspect out of Cornerstone’s financing maintenance operations of loan boarding so you can payoff, permitting our team players to a target what counts very: a remarkable customer experience. Cornerstone’s devoted loan maintenance party usually continuously elevate every facet of the loan upkeep process to raise the club getting customer care, said Toby Wells.

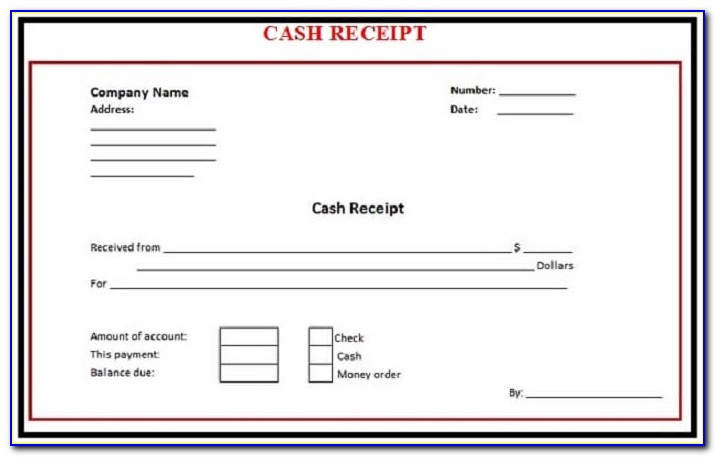

Clients are provided a room out of on line products to easily access and you can do the mortgage account anytime, anyplace. Cornerstone’s member-friendly financing upkeep website and you can cellular application give fast suggestions, such as for instance asking statements, escrow craft, and you will many different commission solutions and rewards calculators. Self-provider potential enable Cornerstone users to rapidly enter for services eg since autopay, biweekly costs, and paperless statements. Users can also content with Foundation team members and you will supply beneficial informative resources, emergency information, and a lot more.

Concurrently, Cornerstone’s maintenance system optimizes state-of-the-art interior processes, particularly supervision and you can monitoring of escrow and you will income tax passion, make it possible for proactive handling of customers’ escrow membership. Thorough mix-platform statistics give actionable insight to assist streamline process, create and relieve risk, and you can hone the customer sense. Foundation will continue to roll out the newest loan servicing provides and you may options for users because grows the inside the-domestic servicing procedures.

The selection of Black Knight’s cutting-boundary upkeep tech platform, in addition to compassionate and experienced Cornerstone associates, brings a premier-of-class financing servicing experience getting Cornerstone people with the longevity of their mortgage

On the Cornerstone Family Credit (Providers NMLS 2258)Depending inside 1988 during the Houston, Tx, Cornerstone has actually assisted household with well over 450,000 a mortgage deals. Cornerstone’s step 1,900 team members are guided by a non-flexible Purpose, Sight & Convictions declaration. Foundation is renowned for the dedication to closure mortgages towards the time; its compassionate, romantic and you can experienced downline; comprehensive array of imaginative home loan lending options and you will qualities; formal Great place to get results reputation, several Best Offices honors and identification since an effective Ideal Workplace during the multiple significant places. For more information, see houseloan.

Our team members is 100% dedicated to putting some mortgage processes while the simple as you are able to. And this connection expands outside the closing table. Our company is pleased to render the website subscribers additional control, independency, and you may openness during the controlling the complete lifecycle of their mortgage.

Leave a Reply