It is because your get is short for your credit report and you may an excellent a great rating implies that you have been responsible for credit into the going back. Your credit rating could be higher when you yourself have paid down the dated bills, whether it is fund or credit card debt, punctually, have taken a mixture of covered and personal loans, while having a decreased loans utilisation ratio.

Your house loan interest rate the lender fees your, whether or not competitive otherwise highest, relies upon the latest get bracket you fall in. It affects their EMI and the affordability of your home loan. You need to manage good credit to possess a frustration-free borrowing feel.

Read on to understand what interest we offer centered on your credit score. Think of utilizing the financial EMI calculator in order to estimate your home mortgage EMIs beforehand.

Credit history regarding 760 and you will significantly more than

This is the finest credit score to own home loans and you may assurances you that the bank offer a knowledgeable interest. This means which you have addressed your debt effortlessly on the previous plus don’t features other expenses which might be big enough in order to impression their prospective financial fees. When you yourself have a score within this range, take care of it. You may be entitled to discover an affordable interest rate of 8.50%* so you can %* p.a beneficial. when you have an effective CIBIL score regarding 760 and over.

Credit score anywhere between 700 and you can 760

A get contained in this variety is considered to be best that you modest, based the lender. With your get in this assortment, you can successfully rating an affirmation to have a home loan but on a somewhat high rate of interest.

Improve your creditworthiness if you prefer a lower life expectancy interest. You should check if for example the past financing membership were properly finalized of the examining the CIBIL report and you will pay attention so you can reducing your borrowing utilisation proportion. When you use even more borrowing from the bank, your own ratio is actually high, which lowers their get.

Credit history lower than 700

A rating below 700 is considered modest and you may mostly attributed to first-go out individuals. Such as for instance, you may have so it score for those who have zero credit history, and you may loan providers would still agree your home mortgage within a higher interest.

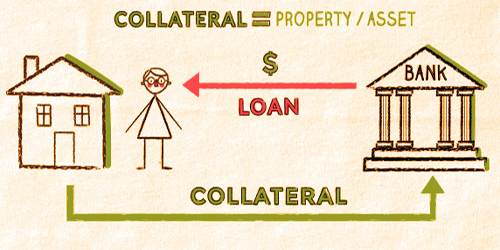

One of the most preferred steps you can take is grab a good collateral-100 % free mortgage such as for example a personal bank loan and you will pay it back with the time and energy to make your rating. A different is via getting home financing having a lowered LTV or loan to help you really worth proportion. An amazing LTV are 80% or maybe more in such instances when you put together 20% of home’s value and you can acquire 80% because the financing. With a diminished credit rating, reduce the LTV, and better the possibility was of going home financing at the a nominal notice. Look at your credit rating before applying to own a mortgage and choose a loan provider who offers aggressive rates along with a lot more pros into fees. Bajaj Finserv Mortgage brokers keeps easy qualification standards, promote higher-worth finance from the nominal attract, as well as have business eg good around three-EMI holiday.

- Acquire a lot fewer debts prior to taking a mortgage

- Make certain you pay their charge card expenses completely

- Improve your bank card maximum when you yourself have high use

- Pay EMIs having current expenses punctually

- Stop and also make way too many financing enquiries just before your sign up for home financing

Now you know how essential your credit rating would be to make your home financing EMIs more affordable, continue a check inside it, and you may work with boosting it. Bajaj Finserv gives you pre-approved offers on personal loans, lenders, loans and a number of most other financial products. These types of even offers clear up the Avalon loans no credit check entire process of choosing away from fund and you may cut go out. All you have to carry out was express several very first facts and check out your own pre-acknowledged promote.

DISCLAIMER: While you are proper care try brought to change what, points, and you can functions utilized in or on all of our web site and you can related platforms/other sites, there may be inadvertent discrepancies or typographical errors otherwise delays inside upgrading everything. The information presented in this site, and on associated website, is for site and you can general information mission and the facts mentioned regarding the particular device/services document shall prevail in the eventuality of one inconsistency. Members and you can pages is always to look for qualified advice just before performing on the newest basis of the pointers consisted of herein. Delight just take an educated choice in terms of one device otherwise services immediately after going through the associated unit/services document and appropriate fine print. In case one inconsistencies observed, excite just click started to all of us.

Leave a Reply