Learn all about cryptocurrency

Cryptocurrencies have the potential to reshape global finance by providing alternatives to traditional financial systems. They could enhance financial inclusion, reduce transaction costs, and enable new forms of economic activity https://newcasinos-aus.org/internet-casinos/20-minimum-deposit-casinos/. However, their impact will depend on how they are integrated into existing systems and regulatory frameworks.

Cryptocurrencies are based on blockchain technology, making them very secure, although it’s still up to investors to choose trustworthy exchanges. Cryptographic techniques (the process of writing and deciphering code) are used to issue, verify, and secure transactions. Through public ledgers, transactions remain traceable and unable to be counterfeited. This peer-to-peer digital asset system makes it fast, easy, and inexpensive to send and receive payments worldwide. There’s no currency exchange needed, nor are there hefty fees. Transactions using these financial assets are publicly recorded, stored digitally, and transmitted via encryption, with detailed coding required for transmission and storage.

All about investing in cryptocurrency

Unlike regular money from banks, cryptocurrencies aren’t controlled by any one big company or government. Instead, cryptocurrencies are like public digital record books that anyone around the world can see and keep a copy of.

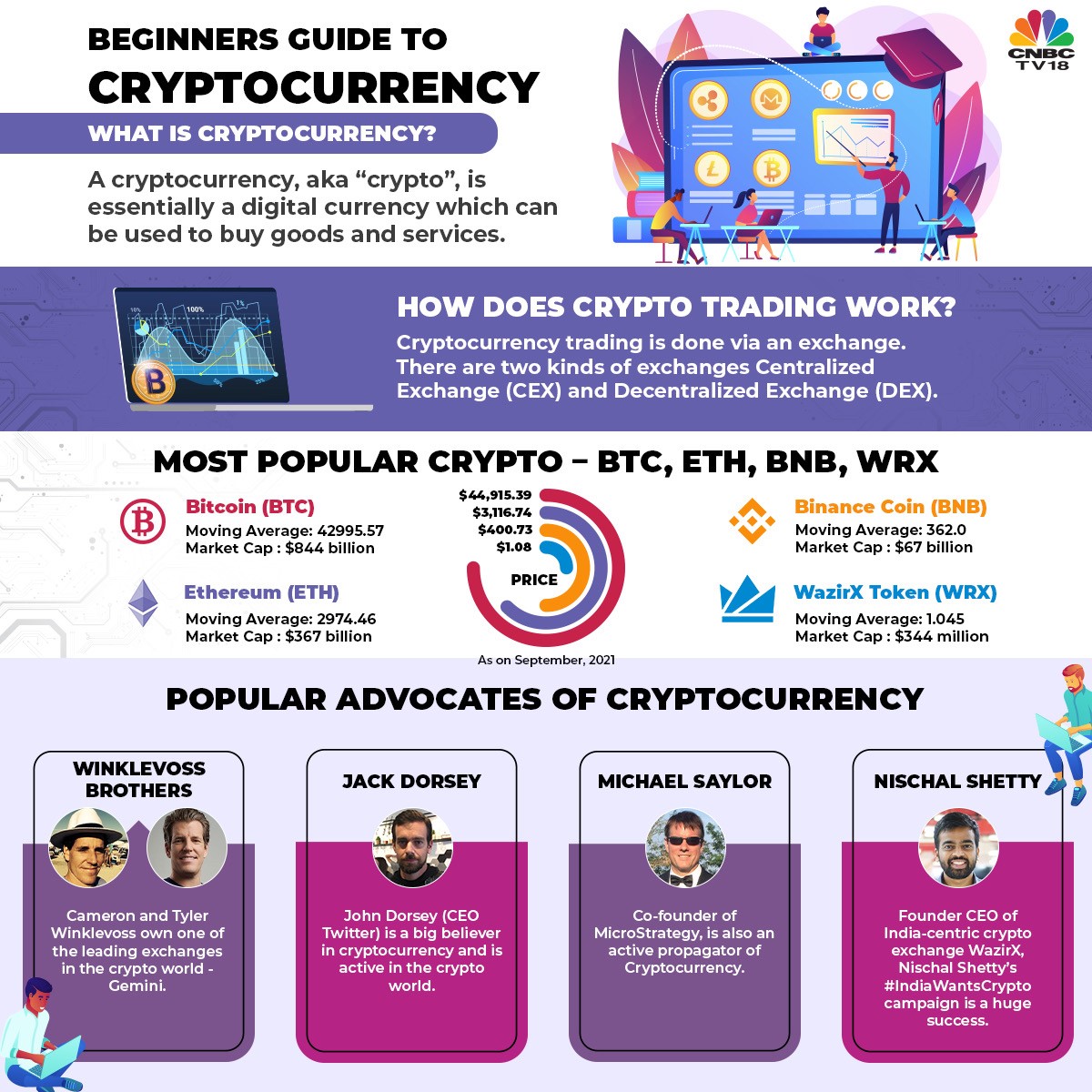

Other than Bitcoin, there are other well-known and recognized cryptocurrencies like Ethereum (ETH) – which is currently trailing Bitcoin in terms of network value; and Tether (USDT)- which is the leading stablecoin also in terms of network value.

Unlike regular money from banks, cryptocurrencies aren’t controlled by any one big company or government. Instead, cryptocurrencies are like public digital record books that anyone around the world can see and keep a copy of.

All you need to know about cryptocurrency

But let’s face it — for many understanding cryptocurrency goes beyond mere speculation; it demands a deep understanding about its underlying technology, how the digital assets work, the force driving their value, and how to navigate the ever-evolving market.

More important than word of mouth, though, are the specifics of a digital currency itself. When you’re considering an investment, take the time to find the project’s white paper. Every cryptocurrency project should have one, and it should be easily accessible (if it’s not, consider that a red flag).

Leave a Reply