Although banks offer a high degree of accuracy, bank errors do occur. You don’t want to lose out on funds because you failed to catch an error in the bank’s records before it caused a tremendous problem. Some banks and credit unions do offer free checks, especially if you only need a few. But a box or book of checks might come with a charge as high as $35.

- If you simply let the aggregator do the work and never stop to check in, this kind of program will not replace manual balancing.

- These aggregators allow you to see an overview of all of your financial accounts in a single place, from your checking and savings accounts, to your loans, to your college savings account.

- For nearly 20 years, we’ve been on a mission to help our readers acheive their financial goals with no judgement, no jargon, and no get-rich-quick BS.

- You can test drive the technology by creating a demo account at passkeys.io.

Why It’s Time to Ditch Passwords and Switch to Passkeys

Either way, it’s still important to know how to write a check and balance your checkbook. But if they charge a high fee for checks, you can order (equally valid) checks online through a third party printer. These tend to be much cheaper, particularly if you plan to use a lot of checks. And look at transactions—not just your overall bank account, but your check transactions—on a regular basis to see if anything is amiss.

There can be delays in processing

In addition, each paper check in a checkbook is preprinted with your name, address, and your financial institution’s information. Understanding both the good and bad about checkbooks and how they work may help you gain better control of your checking account and spending habits. Setting up text or email notifications can make it easier to keep track of new credit and debit transactions without having to log in to your account. She worked for almost two decades as an executive, leading multi-billion dollar mortgage, credit card, and savings portfolios with operations worldwide and a unique focus on the consumer. Her mortgage expertise was honed post-2008 crisis as she implemented the significant changes resulting from Dodd-Frank required regulations.

Review Transactions

We make managing your finances easy by providing access to your data from any device that has internet connectivity. With ClearCheckbook you don’t need to feel like all of your financial data is trapped on your PC. ClearCheckbook is your all encompassing financial management tool. While our foundation is a transaction register, we built many financial tools on top of that such as a Bill Tracker, Budgeting Tools, Reports, Investment Portfolio, Saving Goal Tracker and more.

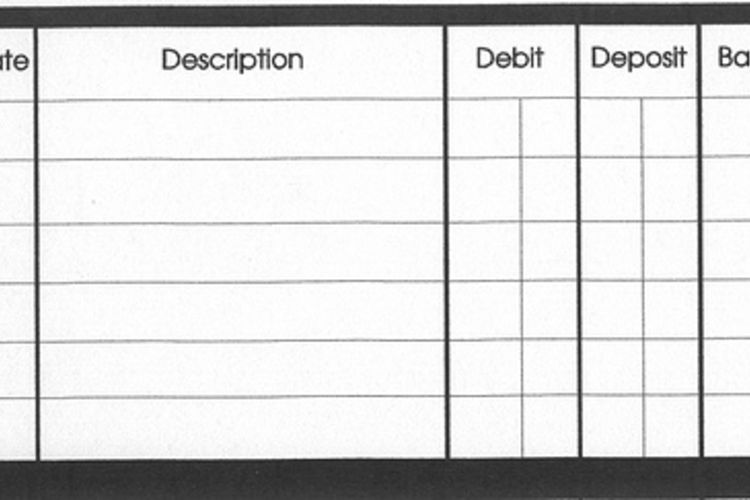

Depending on your business’s needs and preferences, you may have a separate business check register for each checking account (e.g., payroll account and operating account check registers). Do you want to know exactly how much you have available to spend from your bank account? Would you like to catch errors (including bank errors and mistakes you’ve made) before they cause major problems?

How To Balance a Checkbook

With a spreadsheet, you can record deposits and withdrawals while creating formulas that automatically repopulate your current account balance. The key to this approach checkbook accounting is making sure that you enter new credits and debits in a timely manner. Otherwise, you might forget about a transaction, which would result in an incorrect balance.

If you come across a transaction that is unauthorized or contains an error, contact your bank and find out how to get it corrected. Some of your most recent transactions might show up on the following month’s statement. Ensure you note those transactions in your personal record to avoid any surprises. Hold onto any important transactions receipts until you’ve balanced your checkbook for the month.

Checks come with three numbers on the bottom—two long numbers and one shorter number. The first one is your routing number, which identifies your bank or credit union to let recipients know where to “route” the money. The second one is your account number, which identifies your specific account. A check is a written set of instructions for your bank, telling them to transfer a certain amount of money from one account to another. Our partners cannot pay us to guarantee favorable reviews of their products or services. Avoid missing payments and incurring late fees by setting up payment notifications through your app, email or text.

Leave a Reply