Two Applications that have Great features having Pros Located in Colorado

Experts and energetic obligations army authorities provides a few credible money selection to possess house to order this new Tx Vet Program while the Virtual assistant Loan System. If you are each other programs offer buyers exceptional masters and deals opportunities, you need to compare both and know and that alternative is right for you.

Knowing the difference in a colorado Veterinarian mortgage and you will a Va financing is vital for making an informed decision in the to invest in a good house. Out of rates of interest and you will settlement costs into restrict loan amount and you will occupancy period, there are many different testing things to consider whenever choosing a practical financing system for your home purchase.

So you can decide, look at all of our in depth guide from the all of our knowledgeable top-notch in the Colorado family economic issues. We offer that it comprehensive self-help guide to help you select the right mortgage choice one pledges restrict monetary advantage.

Texas Veterinarian Mortgage and you may Virtual assistant Financing Overview

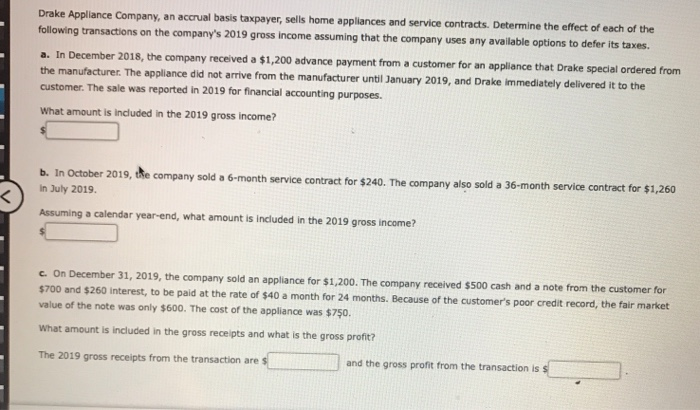

Understand this new vital things of difference between Texas Veterinarian financing and you will Virtual assistant mortgage by this full chart. It will help you finest see the experts and you will amenities supplied by both financing software when you look at the Tx before you choose a fund option for your property.

Texas Vet Speed compared to. Va Financing Rates

The essential difference between a tx Veterinarian financing and you can an effective Va financing is generally according to rates, occupancy, costs, or other vital loan information loans in Bethune. As pris is dependant on their interest rates computation, other variables that can make the a couple of dissimilar try credit ratings and you may price lock conditions. Let’s take you step-by-step through the fresh new Texas Veterans Property Board versus. Va loan details to help you prefer your residence funding choice.

- Texas Veterinarian Loan Costs: The eye cost getting Colorado Veterinarian Finance is actually adjusted a week, towards the newest costs providing feeling every Saturday. Thus the rate you’re offered at the start of the brand new month ‘s the speed that can incorporate throughout that week, taking particular balance in your rate hunting processes.

- Federal Va Loan Pricing: Conversely, Federal Va loan pricing can to improve day-after-day predicated on sector requirements. This fluctuation means that the pace can differ in one date to another location, that could apply at your loan cost over the years.

Evaluating Provides Anywhere between Colorado Vet Loan and you can Virtual assistant Financing Has actually

It investigations chart obviously shows you the difference between a texas vet loan and you may a great Virtual assistant mortgage and you can illuminates the huge benefits pros located throughout the applications. This will help to you choose the essential feasible loan choice you to meets the homeownership specifications that’s appropriate for debt background.

Difference in Colorado Vet Mortgage and you can Va Loan Settlement costs

When comparing Texas Vet financing versus. Va financing closing costs, it gets clear you to definitely both loan software are meant to assist experts in their home to purchase choices. Yet not, he has got different charge and you may costs, privately impacting the general cost of closing the loan. Look at crucial affairs regarding closing costs evaluations.

- This could are a 1% origination commission.

- Potentially includes a-1% participation commission.

- Underwriting fees could possibly get incorporate.

- Disregard affairs commonly acceptance.

- Settlement costs consist of most costs for example appraisal, label insurance rates, questionnaire, and you may state recording fees.

- Texas Vet Loans might have specific energy savings requirements you to fundamentally effect closing costs according to research by the assets.

- Generally, dont are an enthusiastic origination percentage if the bank charges the brand new VA’s step one% flat rate.

Other than such differences between Tx vet mortgage and you may Virtual assistant financing closing costs, each other apps can deal with more will cost you, together with assets taxation, prepaid service attract, and you will homeowner’s insurance. And, the true settlement costs differ towards the bank, the location of the house, and other mortgage specifications. To locate perfect information on new settlement costs out of Colorado Vet and Va finance, consulting with a skilled and faithful financing officer required.

Leave a Reply