All cryptocurrencies

The total crypto market volume over the last 24 hours is $172.65B, which makes a 34.94% increase. The total volume in DeFi is currently $27.22B, 15.77% of the total crypto market 24-hour volume ikibu recension. The volume of all stable coins is now $161.34B, which is 93.45% of the total crypto market 24-hour volume.

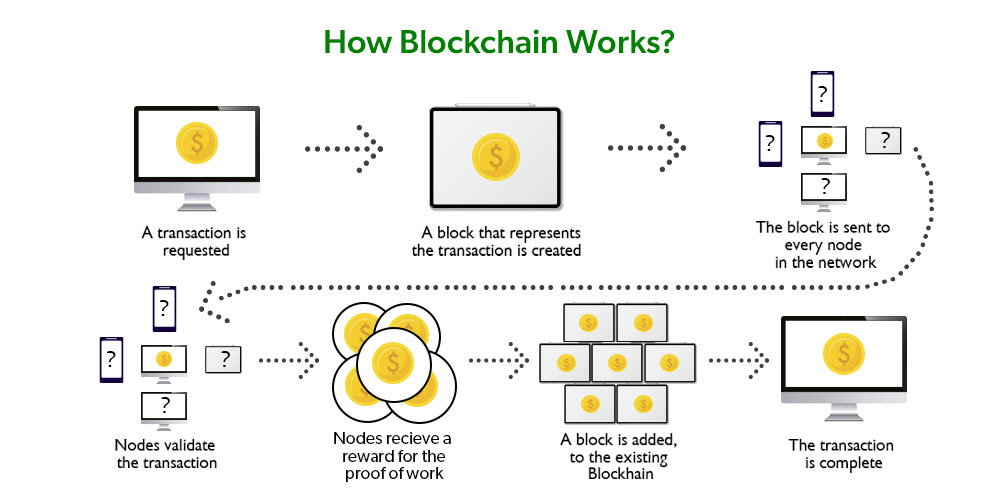

A blockchain is a type of distributed ledger that is useful for recording the transactions and balances of different participants. All transactions are stored in blocks, which are generated periodically and linked together with cryptographic methods. Once a block is added to the blockchain, data contained within it cannot be changed, unless all subsequent blocks are changed as well.

The Bitcoin market cap is currently 2,044.52 billion. We arrive at this figure by multiplying the price of 1 BTC and the circulating supply of Bitcoin. The Bitcoin price is currently $ 102,926 and its circulating supply is 19.86 million. If we multiply these two numbers, we arrive at a market cap of 2,044.52 billion.

The crypto market cap is currently $ 3.31T following a -2.51% decrease in the last 24 hours. Bitcoin is currently the largest crypto asset, accounting for 61.69% of the cryptocurrency market capitalization.

You can find historical crypto market cap and crypto price data on CoinCodex, a comprehensive platform for crypto charts and prices. After you find the cryptocurrency you’re interested in on CoinCodex, such as Bitcoin, head over to the “Historical” tab and you will be able to access a full overview of the coin’s price history. For any given coin, you will be able to select a custom time period, data frequency, and currency. The feature is free to use and you can also export the data if you want to analyze it further.

Do all cryptocurrencies use blockchain

Alternatively, there might come a point where publicly traded companies are required to provide investors with financial transparency through a regulator-approved blockchain reporting system. Using blockchains in business accounting and financial reporting would prevent companies from altering their financials to appear more profitable than they really are.

Three Cryptos To Hold For 5 Years For 100x Profits; Binance Coin (BNB), RenQ Finance (RENQ), Cardano (ADA) In this article, we’ll take a look at Binance Coin (BNB), Cardano (ADA), and RenQ Finance (RENQ), three tokens that will generate 100x returns in the next five years.

On the flip side, PoS is more like the strategic investor, choosing validators based on the amount of crypto they’re willing to “stake” as collateral. While PoW guzzles energy like an SUV, PoS sips it like a hybrid car, making it a more eco-conscious choice.

Alternatively, there might come a point where publicly traded companies are required to provide investors with financial transparency through a regulator-approved blockchain reporting system. Using blockchains in business accounting and financial reporting would prevent companies from altering their financials to appear more profitable than they really are.

Three Cryptos To Hold For 5 Years For 100x Profits; Binance Coin (BNB), RenQ Finance (RENQ), Cardano (ADA) In this article, we’ll take a look at Binance Coin (BNB), Cardano (ADA), and RenQ Finance (RENQ), three tokens that will generate 100x returns in the next five years.

Are all cryptocurrencies based on blockchain

Governance tokens are designed to give holders a say in how a decentralised project or protocol is managed. By owning these tokens, you can vote on proposals, suggest upgrades, or decide how funds should be allocated. They support decentralised decision-making and ensure that control remains with the community rather than a central authority.

After the launch of IOTA, many non-blockchain protocols followed suit. However, most of them invented their own consensus algorithms to protect the network from double-spending attacks. Aside from IOTA, protocols utilizing DAGs also include Nano and Byteball.

The reason for this has to do with what blockchain technology does for cryptocurrencies. Blockchain makes it easy for digital information, such as cryptocurrency and other digital assets, to be recorded securely and publicly. Blockchain technology doesn’t make transactions difficult or complex but instead makes it easier for people to trust the information on the network. It makes it possible to have a similar system to what we call the “checks and balances” in our traditional financial systems, where multiple diverse groups of people make decisions and then are verified as having done so.

Governance tokens are designed to give holders a say in how a decentralised project or protocol is managed. By owning these tokens, you can vote on proposals, suggest upgrades, or decide how funds should be allocated. They support decentralised decision-making and ensure that control remains with the community rather than a central authority.

After the launch of IOTA, many non-blockchain protocols followed suit. However, most of them invented their own consensus algorithms to protect the network from double-spending attacks. Aside from IOTA, protocols utilizing DAGs also include Nano and Byteball.

The reason for this has to do with what blockchain technology does for cryptocurrencies. Blockchain makes it easy for digital information, such as cryptocurrency and other digital assets, to be recorded securely and publicly. Blockchain technology doesn’t make transactions difficult or complex but instead makes it easier for people to trust the information on the network. It makes it possible to have a similar system to what we call the “checks and balances” in our traditional financial systems, where multiple diverse groups of people make decisions and then are verified as having done so.

Leave a Reply