We offer lower Redding, California home loan pricing, punctual closings, and exceptional provider. While in search of to order a property from the Redding urban area or have to discuss the potential for refinancing your payday loans Tariffville current family loan, please don’t think twice to reach out to myself to possess a no cost, no-obligation estimate.

Conforming Financing Constraints Redding, Ca

The latest standard 2024 compliant financing limit during the Redding, Ca is $766,550. Listed here are our home loan constraints for you to five-equipment functions in Redding.

Redding, Ca Home loans

Do you really live in a rural people? Then your USDA home loan system is a superb device to thought. Reasonable cost, and great benefits.

Do you really or did you suffice in the armed forces? Va mortgage system is an excellent solution to believe whenever to shop for a house or refinancing a mortgage.

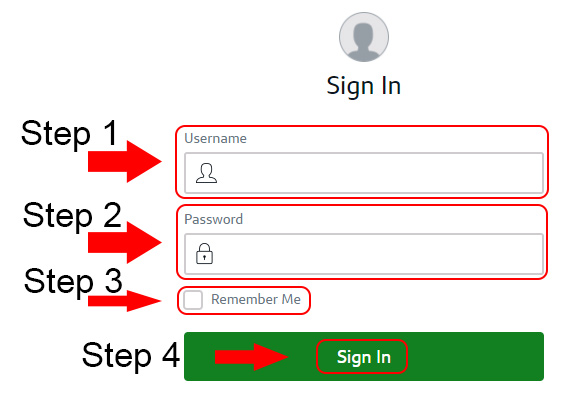

Getting home financing pre-acceptance is easier than simply you think. These represent the easy steps and direction having obtaining property financing pre-approval with a loan provider.

Around three Procedures Getting A mortgage Pre-Approval

- Complete a software means

- Submit the brand new requested documents

- The borrowed funds Officer obtains a duplicate of your credit file.

Listed below are Four Basic Home loan Assistance You should know

- Mortgage lenders like to see the debt-To-Income proportion lower than fifty%.

- When you find yourself purchasing property you’ll need to be in a position to get down at the least step 3% (Va lenders allow for a great 0% down).

- Ideally, you really must have your credit score in the otherwise above 620.

- Domestic lenders only give to one-4 equipment residential properties. Five equipment or maybe more is regarded as a commercial financial.

This is important to consider; most of the lending company varies therefore keep you to definitely in your mind. For many who meet up with the significantly more than guidance it’s not a pledge your gets home financing pre-approval. There are many different mortgage lenders who want less obligations-to-income ratio, increased advance payment, and/otherwise a top credit history.

A button area of the financial pre-approval processes is that you, this new applicant. Delivering real and you will done info is very important. Next, outline precisely what the Mortgage Manager are requesting, and do not replace. Without having precisely what the Mortgage Manager is actually asking to possess, mention by using your/her in advance of submitting your own records.

Always, the pre-acceptance processes takes 24-2 days to-do (this is certainly once you’ve finished the borrowed funds application and filed all of the the brand new expected files).

When you are pre-accepted the mortgage Manager commonly issue you a great pre-acceptance page (when you’re purchasing a house). If you are refinancing your home loan, the borrowed funds Manager often get ready the newest file for underwriting.

Large financial company Within the Redding, Ca

Good Redding large financial company you can rely on try somebody who has the capacity to obtain the most useful mortgage pricing and get brings a high level out of support service. A reliable mortgage broker will normally have 5-ten years of experience, the capability to offer many financial apps, and a premier get with the Bbb, Zillow, Bing, and much more.

Taking extremely important and you can tips on their clients try an option feature too. Here are five instructional posts I do believe all home loan candidate is to see.

House Assessment

This short article provide the ins and outs of brand new Family Assessment techniques. If you’re to buy property or refinancing your existing financial rate of interest next be sure to comprehend my personal Household Assessment blog post.

House Examination

A button part of buying a home ‘s the Family Check. That is an outright need for all earliest-big date homebuyers. Within this easy-to-comprehend blog post, you’ll receive more information about the Household Evaluation procedure.

Documents Must Refinance

A huge action into rescuing big date after you re-finance your existing financial is actually being aware what documents a home loan bank means to re-finance your residence. This simple-to-realize blog post gives a detailed set of the data your might need to re-finance your own home loan.

To acquire a property will likely be stressful nonetheless it has no to help you feel. A proven way it is possible to make it simpler is by knowing in the future of energy just what data the financial institution will need to underwrite the loan. This article will make you more information in regards to the data you need purchase a property.

Leave a Reply