Homeownership could have been a mainstay of your American Dream as the its first regarding 1930s. Yet ,, now, of several People in america thought they will certainly never feel home owners on account of rising home costs and you may interest levels. Forbes reported that in , the common prices to find an alternative domestic is actually $412,000!

Fortunately, all of the hope is not forgotten. There are various applications and you can features to assist men and women during the home-to find process. One particular system is for those with army solution as a consequence of Virtual assistant fund.

Supported by brand new Service from Pros Factors (virtual assistant.gov), these fund promote benefits to help those people from just one of eight uniformed branches (Army, Navy, Sky Force, Marines, Coast guard, Area Force, NOAA, and you will PHS) buy a home. This consists of people in brand new Federal Shield, the Reserves, active duty solution users, and some types of partners.

Exactly how would Va financing work, and you can do you know the guarantee professionals? Continue reading for more information on Va mortgage pros.

Know The Va Financial Pros

- Zero down payment; fund around 100% of residence’s purchase price

- No personal home loan insurance (PMI)

- Aggressive rates

- Lenient credit rating requirements

- Restricted closing rates fees

- Virtual assistant resource payment money (a single-day commission that one can finance to the amount borrowed instead out-of purchasing initial)

Notably, Virtual assistant advantages including vary by the county. Read more in the Florida’s veterans’ positive points to discover professionals book in order to Fl owners.

And additionally buy loans, brand new Va offers almost every other loan programs, instance Interest rate Prevention Refinance Money (IRRRL) and Indigenous Western Head Finance. Refinancing and do-it-yourself loans, such as bucks-away re-finance funds, are also available. Many exact same experts are offered for the various Virtual assistant loans.

Begin Rather than a beneficial COE

Believe it or not, borrowers don’t need a certificate out of Qualifications (COE) to begin with the mortgage process. Loan providers typically have the COE for you when you look at the pre-approval stage.

- This new experienced is destroyed doing his thing or is a prisoner of war (POW)

- New veteran passed away whilst in provider otherwise out of a service-linked impairment, in addition to applicant failed to remarry (conditions apply)

- New seasoned got entirely disabled after which passed away, however their impairment might not have started the cause of passing (requirements apply)

Be aware of the Appropriate Spends

The newest Virtual assistant financial program aims to assist veterans purchase otherwise refinance number 1 residences. They are utilised for the next assets models:

You cannot have fun with a beneficial Virtual personal loan companies Spokane WA assistant financing to invest in a secondary family, doing work ranch, or any income-producing possessions, such as for example a residential property. But not, it is possible to move a first house you purchase having a beneficial Virtual assistant financing with the a rental property immediately after living there having a selected length of time.

Furthermore, it is important to see the eligibility standards for Va financing, plus military service and you can economic standards. As an example, should you have a foreclosures, your generally speaking need certainly to wait a couple of years before you apply for an excellent Va financing.

Manage an excellent Virtual assistant Home loan Savvy Real estate agent

Of many financing officials and you can mortgage lenders try new to the rules away from an excellent Virtual assistant mortgage since it is specialized program with original laws. This new Va information possessions standards our home have to satisfy.

Coping with a realtor which have reasonable knowledge about Virtual assistant funds is good for always find a qualified property. Such as, the best real estate agent will make sure the purchase price drops inside the allowable financing limits so you’re able to qualify for an excellent Va mortgage.

Learn Virtual assistant Mortgage Rates

VA-backed funds routinely have straight down rates of interest than simply old-fashioned mortgages. It is because The fresh new Virtual assistant guarantees the loans. These aggressive Va mortgage rates is that reasoning experts is use Va funds.

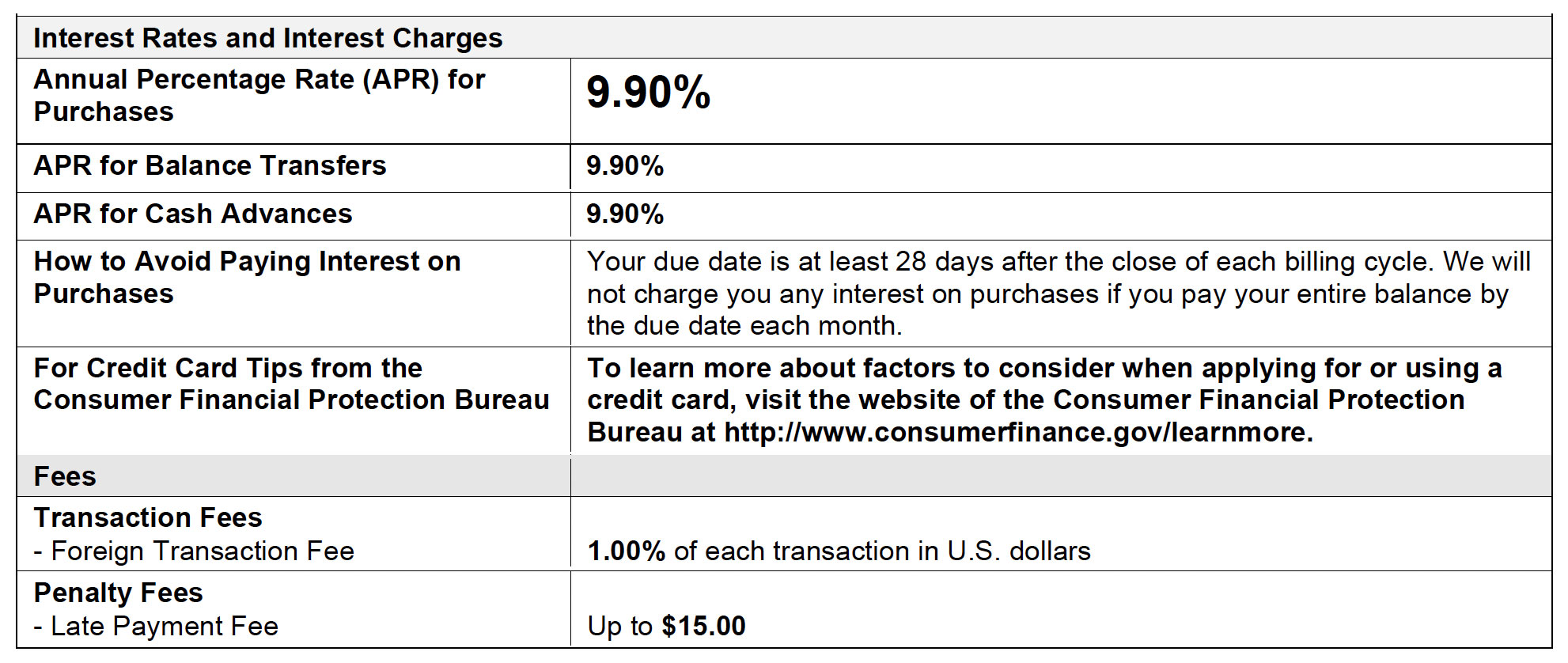

Va fund play with a predetermined speed, which means that the rate does not changes for the duration of this new financing. Since , the speed getting a 30-year home loan try 5.990% (than the fundamental financing rates out-of six.375%). Actually a modest all the way down interest tend to rather get rid of your month-to-month home loan repayments.

Understand what Influences Your own Virtual assistant Mortgage Rate of interest

Even although you get a Va financing which have a lowered credit rating and no currency off, you’ll receive a far greater interest rate when you look at the entitlement (approval) process if the finances come in order. While many people need to have the advantage of the deficiency of stringent eligibility criteria, people that can also be boost their earnings should consider doing this just before getting an excellent Virtual assistant loan.

Work with ideal Loan providers

Even though the You.S. Agency from Veterans Things backs some other financing models through the Virtual assistant mortgage system, personal loan providers such as for instance finance companies, borrowing unions, and you may home loan people make sure the money.

We should come across a lender that won’t simply provide you a interest as well as is experienced having Virtual assistant finance. Commonly, these are shorter loan providers or borrowing unions, perhaps not larger finance companies.

Select Your Va Financial that have Couples Financial

Don’t let your debts prevent you from building house equity. Va home loans are around for help active and retired service players purchase a house and you may feel homeownership. The countless Va financial masters is actually persuading sufficient to see as to why this is basically the right action for your requirements along with your nearest and dearest.

Incorporate now for Va mortgage brokers inside Tampa regarding Couples Household Financing from inside the Florida. We streamline the procedure to really make it easy and to have you to apply while having accepted. I also offer a great many other mortgage brokers, such FHA money, traditional mortgage loans, and!

Leave a Reply