If you were looking an inexpensive solution to borrow a highest sum of money lately, around weren’t of many attractive options to mention. While the rising prices surged, rates for the mortgages, signature loans, playing cards plus rose inside. But when you’re costs into the second two issues soared into double digits, family security credit remained apparently cheap. Household equity financing and you may home security personal lines of credit (HELOC) cost resided less than 10% although rising cost of living struck a years-large and you will home loan rates gone to live in its higher height just like the 2000.

Now, although not, with rising cost of living dropping plus the Government Put aside providing rate of interest slices , this specific borrowing option is to-be actually reduced getting property owners. As the mediocre resident possess over $3 hundred,000 property value equity today, additionally it is a simple way to access a giant amount of money. However if a resident must withdraw $50,000, particularly, which means might possibly be less a HELOC or domestic security loan ? Less than, we’ll break down the potential costs including particular subtleties consumers should think about.

Was an excellent $fifty,000 HELOC or domestic equity loan cheaper now?

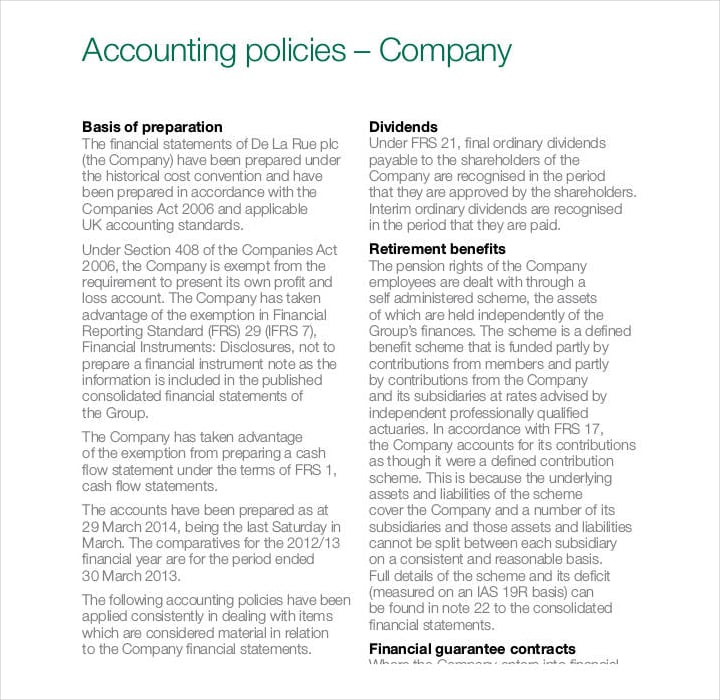

HELOCs and you can house guarantee money enjoys similar however, more interest rates now. The average domestic equity loan speed is currently 8.39% as the mediocre HELOC speed is becoming 8.94%. Here’s what the latest monthly premiums could well be for each if the a great homeowner withdrew $fifty,000:

Family security fund:

- 10-12 months home collateral mortgage on 8.39%: $ 30 days

- 15-12 months domestic collateral financing at the 8.39%: $ 30 days

HELOCs:

- 10-12 months HELOC at 8.94%: $ four weeks

- 15-year HELOC during the 8.94%: $ four weeks

Written down, house security financing is actually some decreased now, nevertheless the difference between the two credit designs is a must in order to see. Home security finance have repaired rates of interest that’ll not change-over the life of the mortgage until refinanced because of the borrower. That’s an as well as in an environment where costs are shedding, it might possibly be detrimental now just like the interest rates take new decline again. HELOCs, meanwhile, has changeable prices one to adjust monthly no action required by the fresh new borrrower. That is a separate virtue today as more interest rate incisions loom, it will need to be mentioned against the keep costs down off a home guarantee financing.

In a nutshell: Household collateral fund are cheaper for qualified individuals at the moment. But when you protect a speed now additionally the full environment will continue to https://paydayloancolorado.net/blende/ cool, a HELOC may become the fresh new cheaper option. Therefore meticulously calculate their can cost you and you can consider your own chance urges so you can narrow down your choice. And remember you to definitely household security financing refinancing isn’t 100 % free. It can normally rates between step one% and you can 5% of one’s full loan amount. But HELOC costs can be rise as quickly as they possibly can slip, too, therefore wanting to benefit from an air conditioning weather you may backfire if costs you should never slide as expected.

The bottom line

Now, its lower to use $fifty,000 property value domestic security which have a house guarantee mortgage alternatively regarding a good HELOC. Nevertheless the speed temperature is usually developing hence you will in the near future change, especially if the Government Put aside things additional interest incisions into the November and you may December. Very start figuring your will set you back today and seriously consider every single day prices for the opportunity to exploit the least expensive home guarantee borrowing from the bank product you’ll. And remember that the home functions as the newest collateral in both credit condition, thus just withdraw a price that you’re safe paying off or you you’ll risk dropping your residence in the act.

Matt Richardson ‘s the controlling editor to the Handling Your bank account section to possess CBSNews. The guy writes and you may edits stuff in the individual financing anywhere between offers so you’re able to purchasing in order to insurance rates.

Leave a Reply