Palms be a little more preferred having homebuyers taking aside high financing

The latest housing marketplace provides managed to move on somewhat in past times several years, such concerning mortgage rates. When you look at the height of your own pandemic, pricing struck record lows, and that benefitted homeowners at that time. But not, prices upcoming risen to a good 20-12 months high. From , the average 30-seasons, fixed-rate home loan (FRM) flower because of the 422 base points, otherwise 4.twenty two fee affairs predicated on Freddie Mac investigation. Meanwhile, rates toward 5/1, adjustable-rate mortgage loans (ARMs) enhanced because of the only 292 basis products, or dos.ninety five fee points from inside the exact same date.

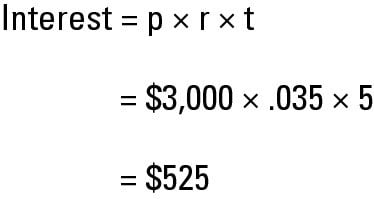

The concurrent increase in home loan cost and You.S. homes prices enjoys resulted in a drop inside cost. As the FRMs improve, specific homebuyers is actually exploring alternatives such Possession and you will buydown factors to dump their monthly obligations, especially in the initial period of the mortgage. For each payment area boost in financial rates mode more month-to-month can cost you to own homeowners and results in higher monthly obligations.

Given that construction bubble bust when you look at the 2007, FRMs are usual weighed against Arms. New share off Case buck frequency from inside the home loan originations in order to a low of dos% during the middle-2009. Since that time, the newest Sleeve share provides fluctuated between up to 8% and you may 18% off home loan originations, according to the prevailing FRM speed (Contour step 1).

Brand new Sleeve show refused from inside the pandemic and you may struck an excellent 10-12 months lowest out-of cuatro% away from mortgage originations into the . Yet not, because FRM interest levels increased off less than 3% to account submitted in , Possession have achieved restored notice. Since , this new Arm express accounted for 18.6% of your own buck quantity of traditional solitary-household members home loan originations, quadrupling from the reduced.

Evaluating the brand new Arm Give Mortgage Pricing:

The newest Sleeve show varies rather predicated on place and you will amount borrowed. Arms be much more preferred to own homeowners taking out higher funds, specifically jumbo money, versus individuals with less funds. Among mortgage originations surpassing $1 million within the , Palms comprised 45% of your own dollar regularity, a 6 commission-part increase away from ong mortgages from the $400,001 so you can $1 million diversity, the brand new Arm express is actually up to 17%, up from the cuatro payment factors off . Getting mortgages from the $two hundred,001 to $eight hundred,000 diversity, the brand new Sleeve show was just 10% in the .

Conventional Arm Show because of the Mortgage Size:

While the Arm display is on the rise which have growing mortgage prices, it remains lower than and various than pre-High Market meltdown account. The best Possession now may be the 5/1 and you may eight/1 designs, which eliminate exposure.

In comparison, to sixty% from Palms which were came from 2007 was indeed low- or no-documentation financing, compared to 40% out-of FRMs. Also, when you look at the 2005, 29% of Sleeve consumers had credit ratings lower than 640, while you are just thirteen% away from FRM consumers got equivalent credit ratings. Already, almost all antique financing, plus both of your arms and FRMs, require full documentation, are amortized, and are built to borrowers having credit scores a lot more than 640.

As Fingers has down first interest levels than simply FRMs, homebuyers experience more important monthly coupons at first, particularly for big money. But not, interest actions try erratic and you will associated with benchmarks eg Covered At once Money Price, that may fluctuate. It is very important remember that there’s absolutely no make certain home loan rates usually lose down the road, https://paydayloanalabama.com/georgiana/ presenting a built-in interest exposure one Arms could lead to improved monthly premiums

In addition, FRM homeowners don’t have to value increased month-to-month mortgage payments. Whenever fixed costs were low, Hands reduced within the popularity However, since the repaired pricing raise, Possession are receiving more desirable so you’re able to homeowners who wish to keep the initial mortgage costs as low as possible. An arm might be the ideal alternative if it aligns that have the latest homeowner’s otherwise homebuyer’s affairs.

The speed towards the 31-seasons FRMs increased so you’re able to six.9% in the . Although not, the interest rate to your 5/1 Arms rose merely to 5.7% within the (Source: Freddie Mac computer).

Leave a Reply