From the Amanda Dodge

Obtaining a mortgage is a crucial part of shopping for an excellent household, but some everyone is baffled by this procedure. One to analysis unearthed that 78% of men and women installment loans online Minnesota imagine shopping around for home financing is at minimum moderately problematic, while 30% said securing home financing is actually harder than simply toilet degree an infant.

Understanding the financial app process normally enable you to build smart decisions when protecting a home loan. This informative guide uses $three hundred,000 because the a standard in order to understand mortgages and you may calculate your percentage possibilities. Learn the means of delivering a mortgage toward a good 300k domestic and apply that it math into the latest state.

Key factors Impacting Your own Month-to-month Mortgage payment

A mortgage isn’t one entity, but instead numerous issues you to definitely donate to the monthly payment. That is great news getting homeowners. This means there are several strings you could remove to adjust the brand new fee count, interest rate, and time period to settle the borrowed funds.

Once you learn the weather that comprise your mortgage payment, you can adjust them to meet your needs. Here you will find the some factors you will work at.

Down-payment

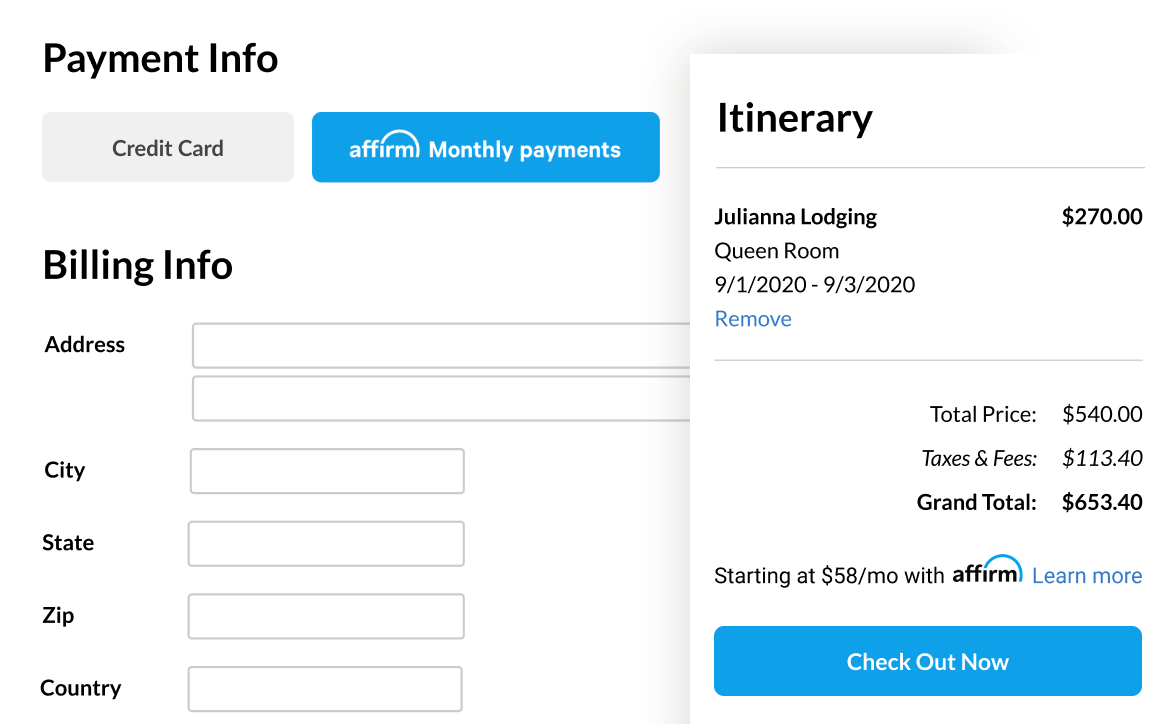

The first number to calculate is your down payment, which is the amount you can put toward your house. In 2023, the median down payment was 15%, which is $45,000 for a $300,000 house. However, first-time buyers had an average down payment of 8% and some loans by the Federal Property Connection (FHA) only require a 4% down payment. This means you could potentially buy your $300k house for as low as $6,000 to $12,000 down.

Reduced down payments are useful to have people that simply don’t keeps a beneficial lot secured, nonetheless always mean you’ll encounter a larger payment per month. You will not only provides a much bigger financing, however you have a top rate of interest as bank was using up significantly more chance by giving you a home loan.

Amount borrowed

The loan count ‘s the price of our house without your own deposit. This will be also known as the prominent of your financing. If you purchase an excellent $300,000 domestic and then have an effective $30,000 down-payment, your loan count was around $270,000.

The loan amount would be a little large in case the home loan lender discusses your closing costs and other charge regarding the fresh new financing.

Interest

The speed is basically the cost of the mortgage. When you are government interest levels can provide a quotation of everything you will pay for your own financial, you can pay a top or lower count according to their financial and the chance associated with the the loan.

Lower-exposure funds are apt to have lower rates of interest. You can lower your risk peak by offering a top down payment, with a premier credit history, and having a reduced obligations-to-income ratio. Even quick changes in rates helps make a distinction.

One example determined the mortgage differences to your an effective $180,000 financing. A single % interest rate boost led to the consumer investing $37,000 a great deal more in the notice along the mortgage. Obviously, this is simply an example as well as your actual interest all hangs on your financing proportions and you can speed.

Check around to various loan providers to meet the focus rate possibilities. You could prefer home financing business which provides positive rates and safer money on your month-to-month mortgage payments.

Mortgage Label

The term talks about the time it will take on how to repay your loan. Very mortgage loans are either fifteen-season loans or 30-seasons money.

If you find yourself a 30-12 months mortgage possess straight down monthly premiums, in addition, it usually includes a higher interest. Loan providers have a tendency to reward borrowers who would like to repay the money less.

Leave a Reply