- You prefer enough income. Lenders require individuals for enough income to cover the borrowed funds payments. Really lenders evaluate it by figuring the debt-to-money proportion, which ultimately shows just how much of your own money goes to spend expense.

Make 1st step To purchasing A house

A home collateral mortgage are an additional mortgage. Before you agree to this obligations, it’s best to consider all aspects associated with the the latest loan.

Your financial Specifications

Basic, thought the reason you are taking out fully a home equity financing. It could seem sensible discover a new family equity mortgage if make use of the bucks to cover anything payday loans Groton Long Point that have much time-label worth, for example home improvements you to help the property value your property or knowledge that enables one to enhance your money. It generates faster feel so you’re able to acquire guarantee to cover way of life costs, a secondary or even an automible as you’re going to be paying off the fresh loan long afterwards its well worth. It might sound right if that’s the case to look for a beneficial appropriate monetary service.

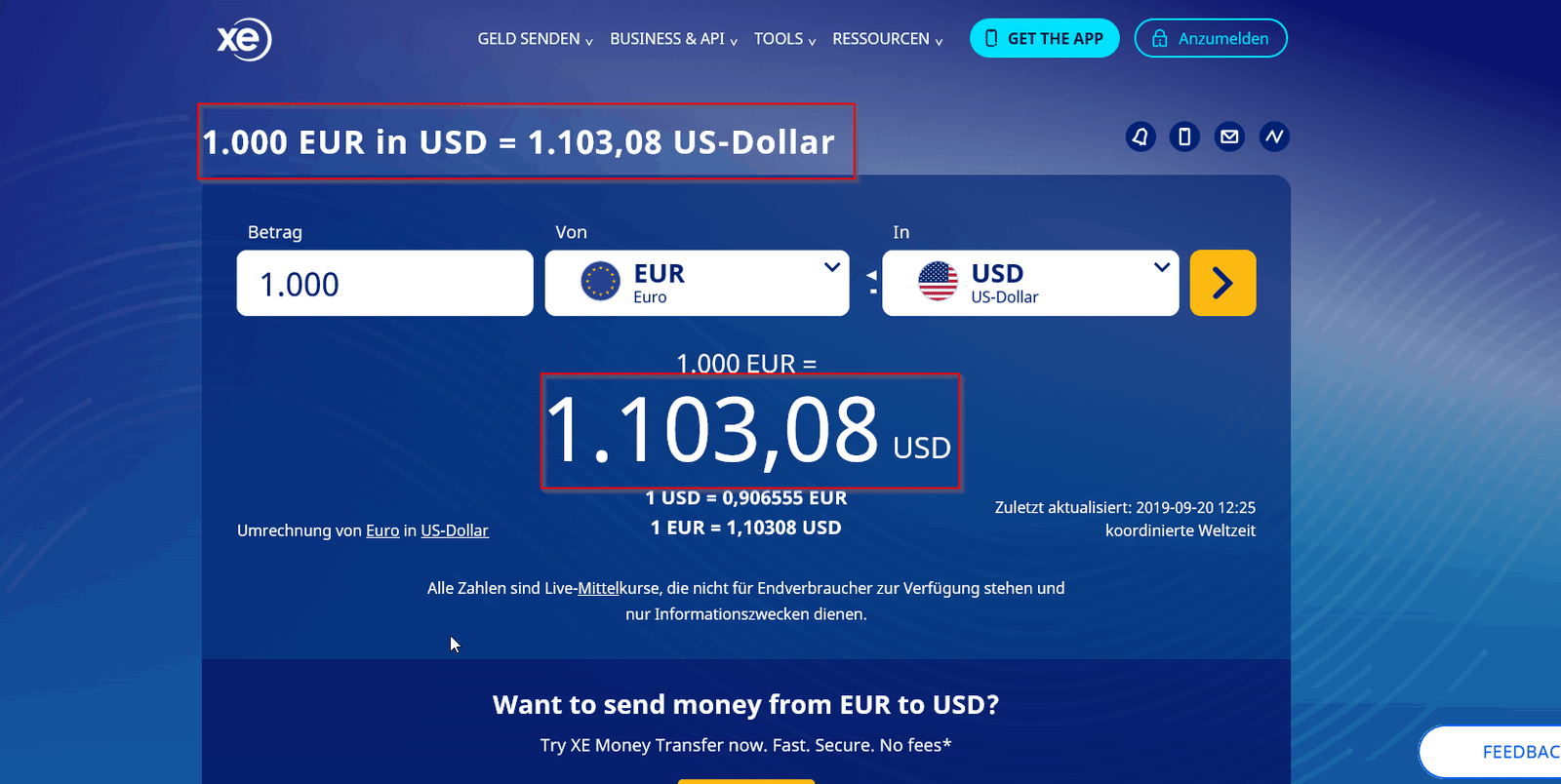

Interest rates

Before you apply having property security financing, envision each other sector interest levels together with rates in your established mortgage brokers. When taking out another house security mortgage, you should expect the rate getting higher than your do on your first financial and you will basic house security financing.

In the event that interest levels try more below the interest rate connected with the home loan, a profit-away refinance can make much more feel than a special house guarantee loan. A reduced interest could save you a king’s ransom when you are providing you with access to dollars.

When the interest levels are significantly more than the speed in your established home loan, this may add up to hold onto your established home loan and sign up for an alternative house collateral financing. Even when the new household equity loan get a high attention speed, you might make use of cash instead of and also make the modern home loan way more costly.

Threat of Foreclosures

Your home functions as security for your financial along with your household guarantee loan. Taking out fully numerous funds on a single advantage threats overextending the earnings. If you cannot afford your loan repayments and standard, your exposure foreclosure and shedding your residence altogether. If you find yourself worried about what you can do to settle multiple house guarantee loans, then you might decide to skip the even more loans.

An excessive amount of Financial obligation

The obvious drawback off taking right out multiple home collateral loans is actually which you are able to add to the debt burden any time you grab aside another mortgage. With every most monthly payment, you are able to reduce your bandwidth to pay for almost every other financial needs. Before you take away yet another family guarantee mortgage, take into account the strain it may wear your financial budget.

Credit Effect

New fund influence your credit rating. Numerous family security funds you are going to boost your credit history for many who make prompt costs. Your credit rating may decrease if you skip payments into the all of your funds.

Settlement costs

You should shell out settlement costs when taking out property equity loan. Because particular amount may vary, we provide settlement costs in order to full between 2% and you can 5% of amount borrowed.

Including, if you take aside property equity loan to possess $fifty,000, the closing costs you’ll slide anywhere between $step 1,000 to help you $3,000.

Pros and cons out of Multiple Household Security Loans

- Turning equity toward cash. When you have adequate equity, a property guarantee loan lets you turn it for the dollars your can use to cover tall expenses.

- Seemingly low interest. Family equity-situated financing boasts somewhat all the way down interest levels than many other borrowing from the bank choice, including handmade cards.

Leave a Reply