The brand new Houses Possibilities Coupon homeownership program allows individuals who be involved in the program to use its coupon buying property and found monthly direction for fulfilling homeownership expenditures. This program isnt provided by the Personal Construction Agencies (PHA), and each PHA has got the discernment to make usage of new HCV homeownership system in their legislation.

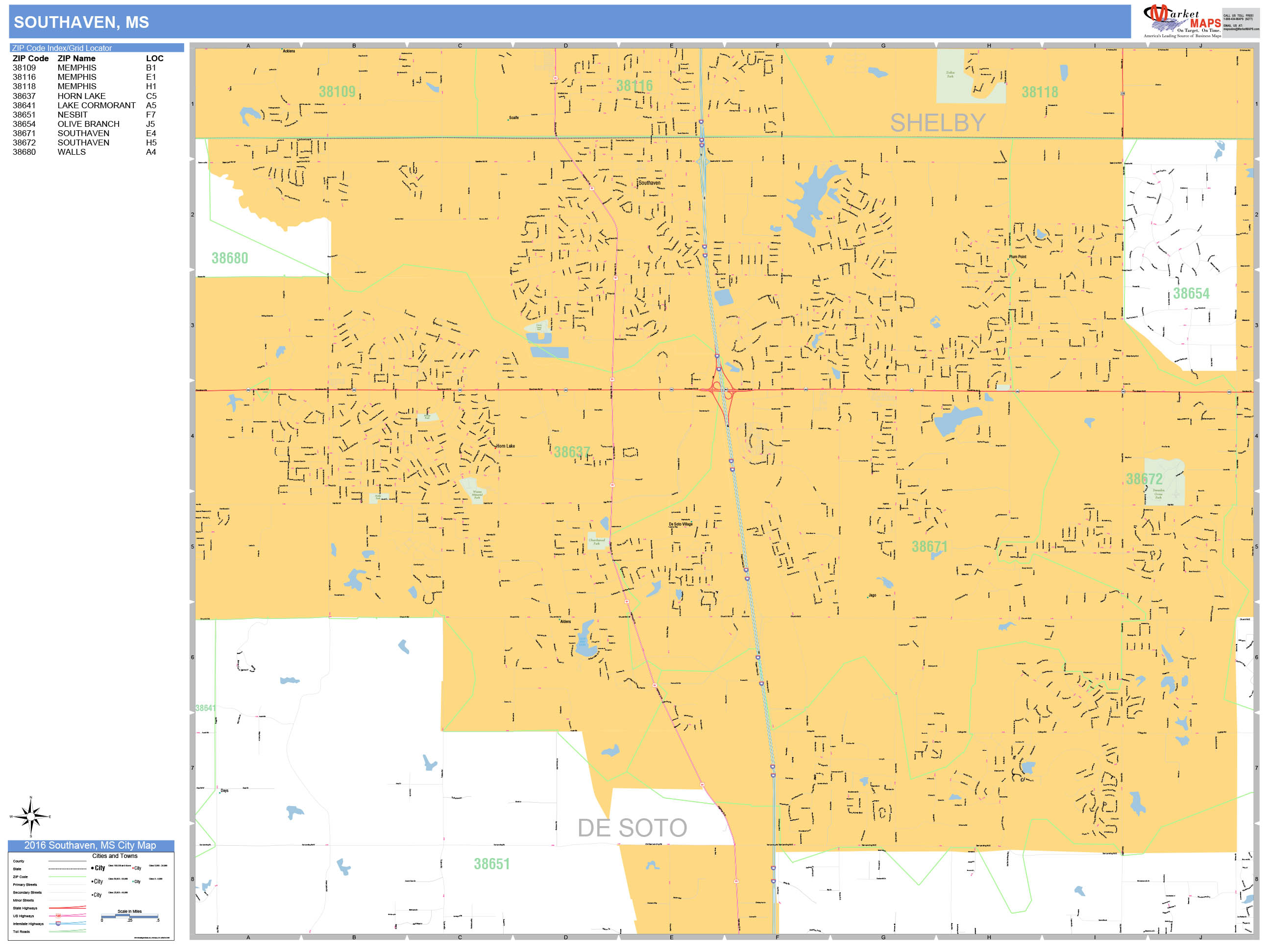

You ought to use the HCV enrollment are accountable to see if truth be told there are PHAs you to accept the newest HCV homeownership program towards you. It’s also possible to see PHA contact information by visiting brand new Agencies of Property and you will Urban Creativity (HUD) PHA contact page and hitting your state toward interactive map.

You need to verify and fill out all the pointers the latest PHA otherwise HUD establishes necessary. This might are, it is not limited to:

Federal Housing Government

FHA finance are capable of reduced-to-moderate-money consumers, including people with a handicap whom located handicap money – each other SSDI and private handicap income. It’s important to understand that new FHA cannot offer you having financing otherwise provide you currency, but alternatively claims the borrowed funds to help you an enthusiastic FHA-approved financial. Brand new FHA financial insurance policies guarantees the loan, offering the bank with coverage facing losings including in case your homeowner non-payments into the mortgage.

For individuals who found impairment money, make an effort to render proof of the handicap income in the one or more, if not more of the following suggests:

To apply for FHA financing insurance coverage, you can loans Trumbull Center check out the newest FHA Mortgage web page, mean that you are to purchase property, mean the latest area code of the home, and offer answers to people required concerns. It’s also possible to envision going to the HUD Lender Number Research to come across a qualified and approved bank that may help you while in the the process of using and buying a house.

Fannie mae HomeReady Home mortgage

A federal national mortgage association HomeReady Home loan does not give you a loan in person however, backs the mortgage once the a conforming mortgage to include usage of low-down-percentage mortgages. Some great benefits of making use of a fannie mae HomeReady Mortgage tend to be:

So you can be eligible for a federal national mortgage association HomeReady Mortgage their bank will need influence brand new debtor and you may loan qualification for the area. You might use the newest Fannie mae Urban area Median Earnings Lookup Tool to get an offer getting for which you want to buy a domestic. Federal national mortgage association HomeReady Mortgage loans are around for very first-go out homebuyers together with individuals with in the past ordered a great domestic. When you find yourself a primary-date homebuyer, you will need to finish the Build on the internet knowledge programmes.

USDA Unmarried-Nearest and dearest Houses Head Mortgage brokers

USDA Single Family members Housing Direct Mortgage brokers let lowest-money people, including people who have disabilities, due to payment recommendations you to definitely increases a good borrower’s cost function having a home loan. Fee recommendations having one Nearest and dearest Construction Lead Financial is a specific kind of subsidy that reduces the homeloan payment to have a short time. The amount of fee assistance is dependent on the fresh new modified family relations money.

Being unable to obtain that loan off their tips into the terms and you will conditions that can also be reasonably expect to end up being fulfilled.

Even more on qualification conditions of the individual, the fresh new features funded which have head mortgage finance need meet up with the following the requirements:

Usually, no advance payment needs, even when people that have assets greater than brand new investment constraints is required to use a fraction of men and women possessions. The rate could be a fixed interest considering current market cost during financing approval, or loan closing, any sort of is lower. The fresh new pay several months into the term of one’s mortgage is usually 33 ages, though it can be offered so you’re able to 38 to possess suprisingly low-earnings candidates that simply cannot afford the 33-season mortgage name.

Leave a Reply