Some lenders function better without a doubt consumers otherwise issues than others. Including, we feel Skyrocket Financial is a great lender to own refinancing while the this has the capability to tailor the name duration, that allows you to definitely avoid resetting your loan title.

Perfect for Earliest-Date Consumers

Within help guide to a knowledgeable mortgage lenders for very first-go out homebuyers, Lender out-of The usa was our most readily useful select. An effective financial getting first-go out people should bring loans and features particularly aimed toward these types of individuals. Discover lenders that have low-down-commission mortgages and offer a lot more help for example down-payment has.

Good for Authorities-Recognized Mortgage loans

- Within our self-help guide to the best loan providers to have FHA fund, The fresh new Western Capital are our very own top find

- Pros Joined ‘s the “top total” see within best Va loan providers guide

- Fairway Separate try the top come across for USDA loan companies

Planning Your Documents

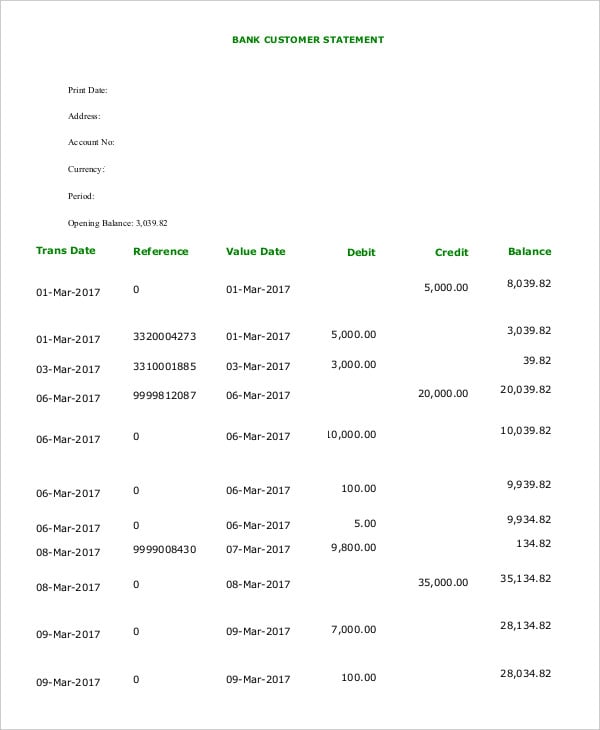

Loan providers commonly require some data files once you get home financing, therefore it is best if you keep them ready to go ahead. This would is paystubs, W-2s otherwise 1099s, taxation statements, lender comments or other house account comments, and every other documentation indicating your revenue and deals.

Knowing the Financial Application Techniques

Generally, the mortgage software processes begins with a preapproval. Using this type of particular acceptance, the lender will require a peek at your own borrowing and cash and reveal simply how much it is happy to lend you in accordance with the pointers they checked-out. You plan to use your preapproval to invest in property and work out even offers.

After you’ve an offer acknowledged, you’ll sign up for recognition. The financial institution can get request way more records during this period, as well as a duplicate of your own signed pick bargain. Shortly after you might be approved, you get that loan estimate with all the specifics of their advised financial, including projected closing costs.

If you move forward, the lending company begins processing and you will underwriting the loan. It can acquisition an assessment to be sure your house was value just what you’ve agreed to shell out the dough, and you will underwriters will work to confirm that you meet up with the lender’s criteria and can afford the mortgage. In the event that all the goes well, you are getting last acceptance and get removed to close.

Most useful Financial Lender Frequently asked questions

What is the most readily useful financial to get a mortgage? Chevron symbol It indicates a keen expandable area or selection, or either earlier in the day / 2nd routing choices.

The most useful select lending company are Bank of America, however, that does not mean simple fact is that ideal financial on precisely how to score home financing out of. An informed lending company for you is one that you be considered thereupon offers the types of mortgage you are searching for and can provide the best deal when it comes to their interest rates and you will fees.

Exactly what bank has got the reasonable mortgage costs? Chevron symbol It indicates an enthusiastic expandable part or diet plan, otherwise both earlier in the day / next navigation possibilities.

For the lender towards the lowest home loan prices, i encourage bad credit installment loans Vermont Better Home loan considering their mediocre pricing when you look at the 2023, however you will discover straight down pricing someplace else according to your personal financial predicament. Take a look at Providers Insider’s every day mortgage rate standing to help you comprehend the mediocre home loan pricing for different title lengths.

When you get preapproved by the numerous loan providers? Chevron icon It means a keen expandable point or eating plan, or sometimes past / second routing selection.

Yes. You really need to get preapproval with more than one to lending company to compare the fresh new costs and features you are to be had while making yes you will get the best price.

How much is actually home financing application commission? Chevron symbol It means an expandable point otherwise diet plan, otherwise both past / 2nd routing selection.

Leave a Reply