Just like the a mortgage merchant you are almost certainly searching for innovative new loan affairs to help separate your business if you are helping the requirements of your customers. Well take a look at the All in one Mortgage of CMG Financial, offered using all of our General Credit Conversion Section in discover places round the the nation.

- Loan quantity up to $dos billion (geographic limits get use)

- 31 season name domestic collateral line of credit which have 29 year mark accessibility

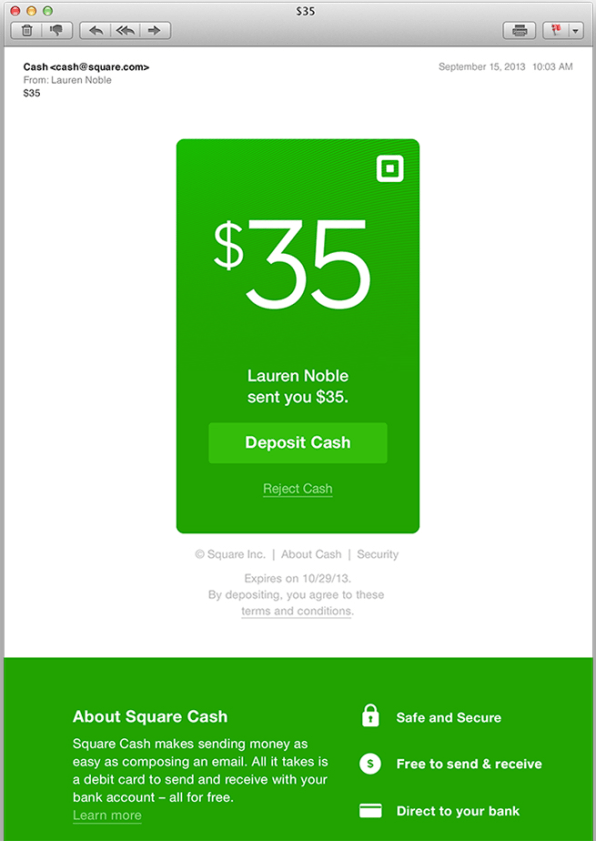

- Inserted brush-checking account which have 24/seven financial usage of personal line of credit and you will financing

- Atm debit POS notes, limitless check writing an internet-based costs-shell out and you may statement come

- 10% advance payment importance of commands

- Get and you can re-finance deals desired

- Top, Next Belongings, and you can Non-Owner filled house

- Unit availableness online installment loans South Carolina could be geographically minimal

Releasing The new All in one Financing

Exactly why are brand new All-in-one Mortgage therefore effective is that it’s just not an elementary signed-finished financial, but alternatively, property security line of credit. Lines of credit was novel because they’re flexible, two-way instruments allowing the consumer to use as often currency since they need for the the balance instead shedding access to their money. Brand new All in one will bring 30-season use of home security bucks, keeps a low-rate, with no hidden charges otherwise required balloon payment.

Which leading edge build lets your potential customers to use their everyday dollars circulate so you can offset its loan’s harmony and rescue home loan interest versus requiring a change to its budget.

Deposits made into the new Everything in one Mortgage lower principal first and stay offered 24/7 from the financial provides. The mortgage boasts Automatic teller machine notes for everyone pages of one’s membership, secured on the internet expenses-shell out, unlimited check-writing, head deposit and you can financial-to-lender wire moving. Their buyer’s month-to-month interest repayments are computed on every day’s finish balance, therefore even as they detachment funds from its make up normal expenses, their loan’s each day equilibrium is actually remaining straight down for longer – and therefore equates to your faster appeal getting charged than with an excellent traditional financial.

In effect, the customer avoids spending significantly more appeal on the financing with their typical income than they might usually secure towards the individuals bucks inside an everyday family savings. A reduced amount of their money allocated to month-to-month financial attention setting far more of its currency remaining to assist them see most other monetary expectations.

The Field

Think about what your own sector has been by way of throughout the past ten years. From property growth to homes bust and you can prevalent economic suspicion – lessons was read. Actually, top sales that took place given that beginning of the the newest 2008 economic crisis is how Us citizens perceive financial obligation – especially homeowners – and also the risk its home loan poses on their total economic wellness.

Even with regulators input and you may list low interest, many homeowners still are obligated to pay trillions away from dollars to their land and you will not be able to get the fresh wide range needed in their functions and conserve to have advancing years.

However it don’t has to be that way through the revolutionary All-in-one Loan. Towards the Everything in one Loan, you could potentially help your prospects avoid thousands of cash from inside the excessively financial interest, pay-from by 50 percent the amount of time otherwise less, and you can access their residence’s equity bucks without the need to refinance.

Getting started

The newest All-in-one Loan seems to create new customers having just mortgage originators but suggestion provide also. Simultaneously, it can help you will always be hectic and you will effective throughout the adverse rate surroundings because it’s shorter based upon than old-fashioned mortgages towards the attention rates to provide discounts.

Analysis team a support and contact a beneficial CMG Financial Section Transformation Manager to begin the degree with this innovative loan unit now.

Leave a Reply