While the retirement steps, financial balances becomes a paramount question. Like many other People in the us, your home is not simply a place out-of spirits but might even be the most significant investment otherwise accountability on your own portfolio. Refinancing their financial is a very common proper proceed to enhance your finances because you changeover with the retirement. This informative guide often talk about utilizing refinancing effectively as an ingredient off an extensive home loan and you may advancing years considered approach.

Refinancing a mortgage as the a pension approach

Home loan and you can senior years may appear eg line of maxims, however they are intrinsically connected. Refinancing your financial because you close retirement can to change your financial financial obligation to higher suit your anticipated later years income. In your senior payday loans Clayhatchee years approach, it will help eliminate monthly expenditures, protected down rates and you will release dollars to possess opportunities crucial for retirement many years.

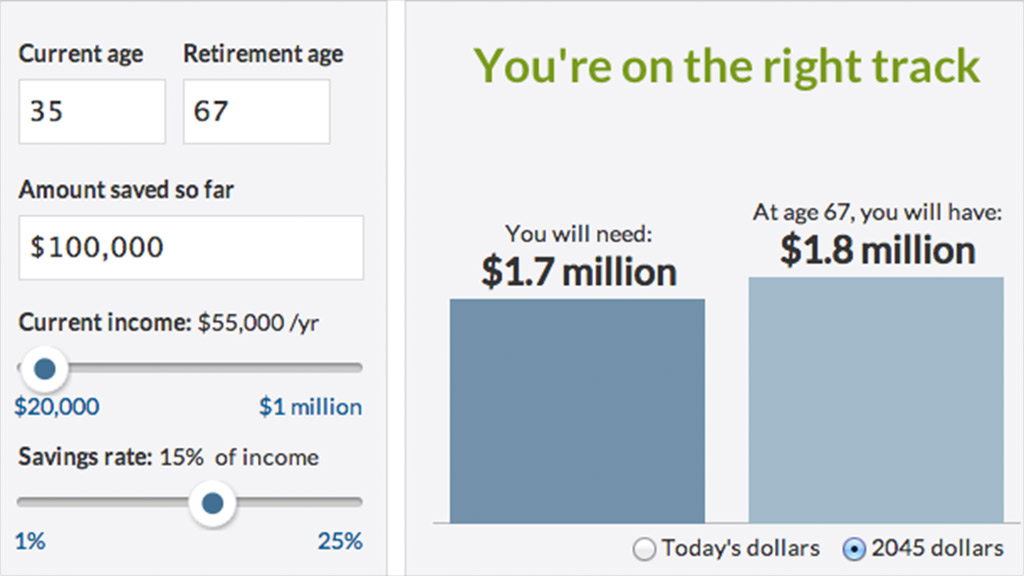

To own retired people, a primary real question is commonly: How much cash should i retire? Old age earnings generally speaking decreases compared to the pre-advancing years membership. Hence, adjusting month-to-month expenditures so you’re able to line-up with senior years earnings will become necessary. An important purpose of refinancing often is to minimize monthly costs and increase earnings. You can secure debt coming of the integrating home loan re-finance procedures into your old-age considered.

Whenever should you decide think refinancing their mortgage?

Interest rate falls: Refinancing is most beneficial whenever prices is actually rather beneath your most recent home loan speed. A principle would be the fact a-1% rates lose could make refinancing worthwhile.

Increased credit history: If your rating has actually improved as you very first obtained their financial, you can now be eligible for straight down mortgage refinance pricing.

Equity build-up: Refinancing could be useful for those who have built-up high home security. Certainly one of U.S. property owners, home equity illustrated an average regarding forty five% of their web worthy of inside the 2021 (Kochhar & Moslimani, 2023). That’s a secured item you could influence courtesy bucks-away refinancing to pay off higher-appeal loans otherwise reinforce pension discounts.

Alterations in monetary requirements: Since the later years nears, debt requirements shift. In the event the cutting monthly expenses or paying off your own home loan quicker aligns with your arrange for later years, refinancing could be the correct action.

Benefits of refinancing before senior years

Refinancing your own financial just before old-age has the benefit of numerous economic positives. Every one of these positives will bring a cushion which will help secure a warmer retirement:

Among visible immediate advantages of refinancing is the potential to lower your monthly payments. There are two main ways to do this: securing a diminished interest or stretching the brand new amortization period of your home loan. For somebody towards a fixed old age money, down monthly installments tends to make a hefty difference between the standard away from life and capacity to create unanticipated expenditures.

Protecting a lower life expectancy interest rate cuts back your payment and you will ount of cash you to would go to appeal along the life of the fresh home mortgage refinance loan. This is why, a lot more of your own fee goes into the dominant harmony, allowing you to generate equity less.

You have situated significant family collateral courtesy home improvements, real estate fancy and you can dominant costs. By the going for a finances-out re-finance, you can access a fraction of your own home’s really worth during the bucks. Next, deposit it dollars to the old age savings, financial investments otherwise settling high-appeal loans.

Generally, a home loan is the prominent costs. You will possibly not must just take so it significant weight with the retirement, while the the average later years benefit of $1,866 (Public Security Administration, 2024) hardly discusses bills. In this case, a move to help you a reduced term – 30-seasons in order to 15 or 10-seasons – to pay back the financial eventually is acceptable. And in case one thing, you save upwards plenty during the attract repayments.

Leave a Reply